That in turn could lead to a higher amount paid to the heirs or beneficiaries of an estate.

History

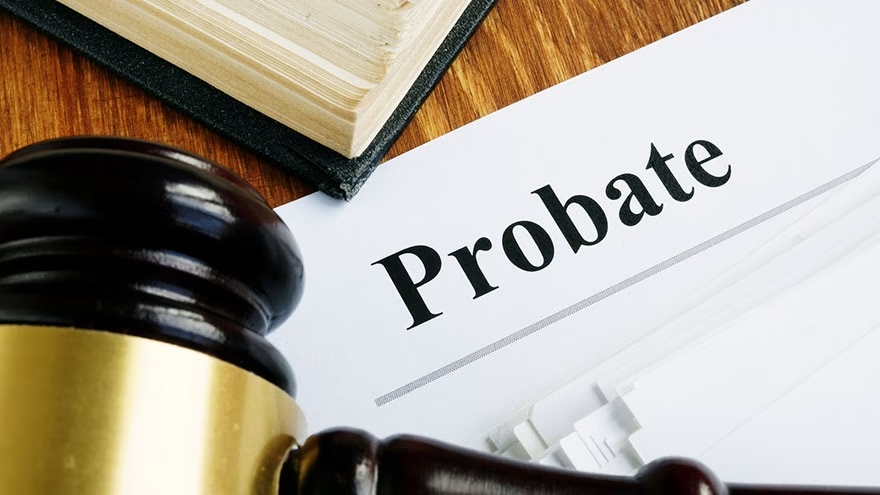

When someone dies in Ohio their estate must be filed with the probate court in the county in which the decedent was a resident. The decedent's assets are listed on a form called an inventory and appraisal.

Significance

The difference between probate vs. non-probate assets is important since non-probate assets are not included as a part of the decedent's taxable estate. This could save thousands in estate tax for the heirs of the decedent.

Non Probate Assets

Ohio defines non-probate assets as those that pass from the decedent to a named beneficiary or co-owner automatically at death, such as an insurance policy, retirement account or jointly held bank accounts. A home or automobile may also be a non-probate asset but the title must be listed as a "joint owner with right of survivorship."

RELATED :: Definition of a Probate Lawyer

Probate Assets

The state of Ohio lists all other types of property as probate assets. Property owned solely by the decedent or property held as as a tenant in common, solely owned bank accounts, and cash on hand at the time of death, are examples of probate assets.

Value

The monetary value assigned to the probate assets is assigned by the administrator of the estate or with the help of an appraiser in order to fairly show these amounts.

You Might Also Like :: Who Needs Probate Court?

Save for later

Found this helpful?

Pin this article to your Pinterest board and come back to it whenever you need a reminder.

Save to Pinterest